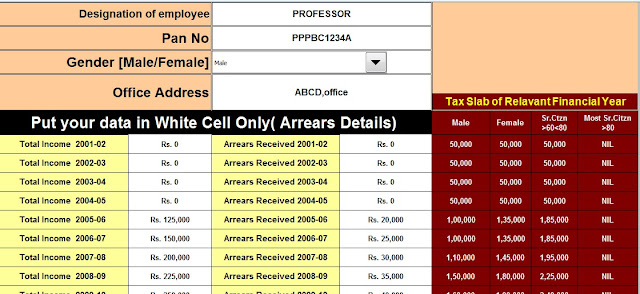

RELIEF UNDER SECTION 89(1) with Form 10E From F.Y.2001-2002 to F.Y.2017-18

Where by reason of any portion of an assessee’s salary being paid in arrears or in advance or by reason of his having received in any one financial year, salary for more than twelve months or a payment of profit in lieu of salary under section 17(3), his income is assessed at a rate higher than that at which it would otherwise have been assessed, the Assessing Officer shall, on an application made to him in this behalf, grant such relief as prescribed. The procedure for computing the relief is given in rule 21A. This relief is called relief u/s 89(1).

We have uploaded Calculator to

This will support the arrears received for last 15 financial years and support the income of financial year 2001-02 to 2016-17.